Blockchain Technology Consensus Solutions

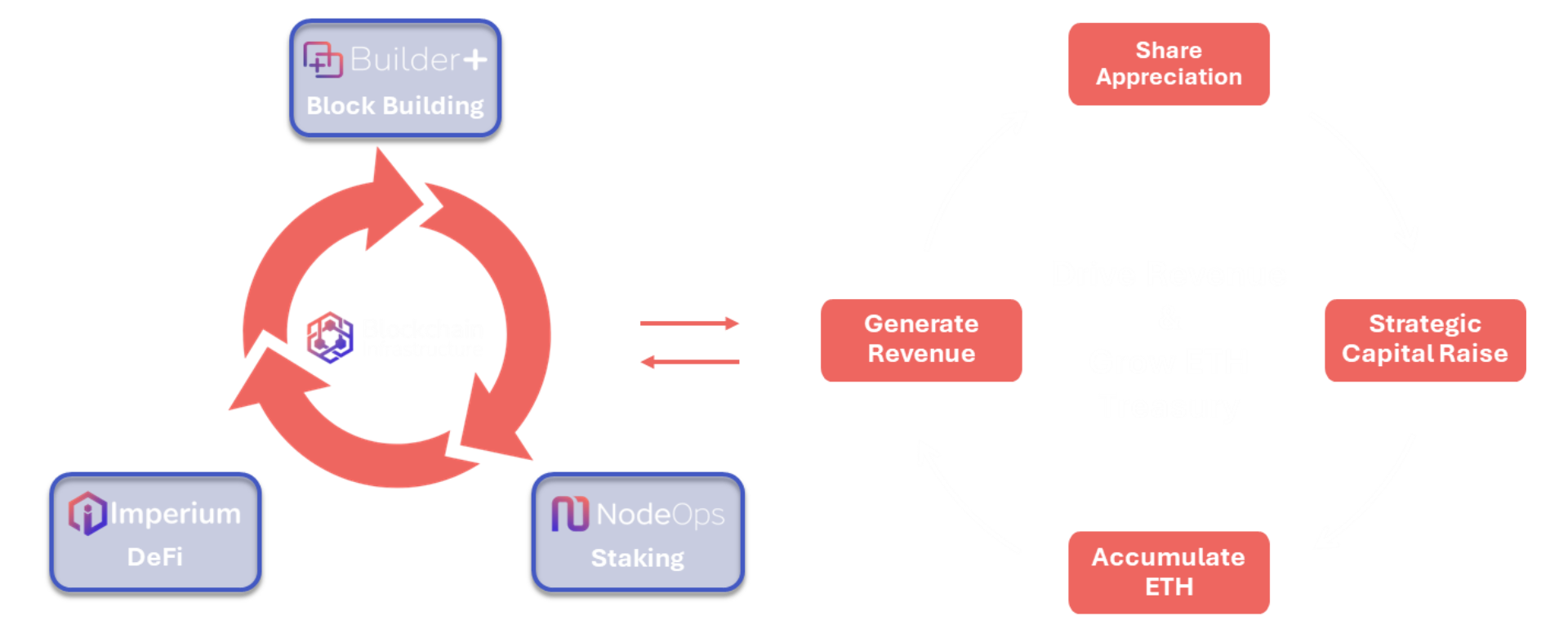

With an unrivaled financial model and vertically integrated operations, we believe that BTCS is the most sophisticated Ethereum play in public markets today. Our core strategy combines blockchain infrastructure with a powerful DeFi/TradFi ETH Accretion Flywheel. We put ETH to work to generate scalable revenue and long-term value for our shareholders.

Ethereum (ETH) Holdings

70,322 ETH

(as of September 30, 2025)

DeFi/TradFi ETH Accretion Flywheel

BTCS is executing the most sophisticated public Ethereum accumulation strategy by integrating DeFi and TradFi into its operations to maximize its ETH holdings.

Check out our latest Investor Presentation to learn more about how BTCS is executing its strategy through this Flywheel.