By Charles Allen, CEO of BTCS Inc.

As Gary Gensler’s tenure as Chair of the U.S. Securities and Exchange Commission (SEC) comes to a close, it’s an opportune moment to reflect on the challenges faced by the cryptocurrency industry under his leadership. While Gensler’s intent may have been to enhance investor protection and market integrity, the reality is that his tenure has often worked counter to the SEC’s stated mission. The intensified scrutiny under his watch has not only undermined the agency’s credibility but has also harmed the very retail investors the SEC is meant to protect.

How the SEC Lost Sight of Its Mission

The SEC’s mission is threefold: to protect investors, maintain fair and efficient markets, and facilitate capital formation. However, during Gensler’s term, this balance shifted dramatically, disproportionately targeting emerging industries like cryptocurrency.

1. Blocking Access to Capital

Public companies in the cryptocurrency space, already subject to extensive disclosure requirements, found themselves effectively blocked from accessing critical capital markets. This not only stifled growth but forced many to turn to toxic PIPE (Private Investment in Public Equity) financings, which carry onerous terms that can severely dilute shareholders. These financing arrangements, often a last resort, disproportionately harm retail investors by eroding the value of their investments and creating a vicious cycle of downward pressure on stock prices.

2. Prolonged Registration Periods

Cryptocurrency companies faced significantly longer registration periods compared to other industries. The average time between an initial S-1 filing and SEC approval increased from 120 days in 2020 to 160 days in 2024, while other industries saw an increase from 90 to 110 days during the same period. For BTCS Inc., it’s been worse. For example, on September 21, 2023, we received a comment letter which took a full year to clear comments.

These delays in accessing public markets directly contradict the SEC’s mandate to facilitate capital formation, leaving innovative companies hamstrung and investors unable to benefit from their growth.

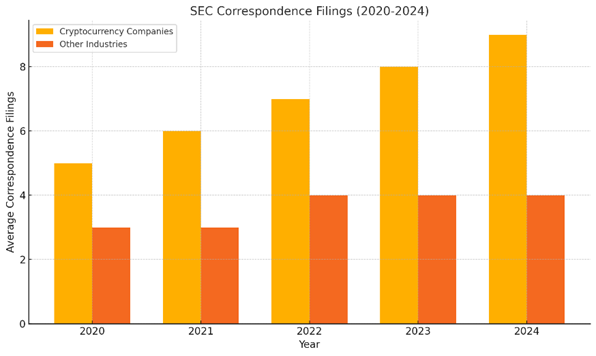

3. Increased Correspondence Filings

Another key indicator of heightened scrutiny is the number of correspondence filings (Form CORRESP) required by the SEC during the review process. For cryptocurrency companies, the number of filings rose from 5 in 2020 to 9 in 2024, while other industries saw a relatively stable average of 3 to 4 filings over the same period.

These additional filings highlight the increased regulatory hurdles faced by the cryptocurrency industry, often delaying capital formation and hindering operational momentum.

A Crisis of Credibility

Gensler’s heavy-handed approach also damaged the SEC’s credibility:

- Selective Enforcement: The SEC appeared to single out cryptocurrency companies for scrutiny while allowing similar practices in traditional industries to go unchecked, raising questions about fairness and impartiality.

- Unclear Guidance: The lack of clear regulatory frameworks for cryptocurrency companies left them navigating a maze of inconsistent rules and unpredictable enforcement actions, creating uncertainty that deterred innovation and investment. For example, in our response to a comment letter on October 15, 2023[1] question #7 asked us to provide “a detailed legal analysis regarding whether the Company and its subsidiaries meet the definition of an “investment company” “, however BTCS’s business model had not materially changed since 2017 when we spent over a year answering the exact same question.

- Global Impact: By pushing companies to operate overseas, the SEC under Gensler not only weakened the U.S.’s position as a leader in blockchain innovation but also reduced opportunities for American investors to participate in the growth of a transformative industry.

Why Gensler’s Departure Matters

Gensler’s departure represents an opportunity for the SEC to realign with its core mission:

- Protecting Retail Investors: Instead of driving companies to toxic financing arrangements, the SEC should focus on fostering an environment where public markets are accessible and beneficial to both companies and investors.

- Restoring Credibility: By adopting a more balanced approach to enforcement and providing clear guidance, the SEC can rebuild trust with the industries and investors it oversees.

- Supporting Capital Formation: The next era of leadership must prioritize reducing barriers to capital access for all industries, especially innovative sectors like cryptocurrency, ensuring that the U.S. remains a hub for technological advancement and economic growth.

A Call for Change

The end of Gary Gensler’s term is a moment to celebrate not out of spite, but out of hope for a better path forward. The SEC must learn from the missteps of the past and work collaboratively with industries to achieve its mission without stifling innovation or harming retail investors.

At BTCS, we are optimistic about what lies ahead. As the cryptocurrency sector matures, we envision a future where thoughtful regulation enables growth, protects investors, and reaffirms the SEC’s role as a steward of fair and efficient markets. Let’s seize this opportunity to build a regulatory framework that truly works for everyone.

Charles Allen

CEO, BTCS Inc.

Leading the charge for transparency, innovation, and investor protection in the blockchain revolution.

[1] https://www.sec.gov/Archives/edgar/data/1436229/000149315223037383/filename1.htm

* Data obtained from SEC.gov utilizing ChatGPT for data analysis.