Increases ETH Reserves by 14,240 to 70,028 via Hallmark DeFi/TradFi Flywheel Accretion Strategy

Closes $10 Million Convertible Notes Issuance

Silver Spring, MD – (Globe Newswire – July 28, 2025) – BTCS Inc. (Nasdaq: BTCS) (“BTCS” or the “Company”), a blockchain technology-focused company, short for Blockchain Technology Consensus Solutions, today announced the successful closing of its issuance of approximately $10 million in above marked convertible notes. This financing, structured at a compelling $13 per share conversion price, a 198% premium to BTCS’s July 18, 2025 closing price, furthered the Company’s hallmark DeFi/TradFi Accretion Flywheel strategy.

In conjunction with this issuance and ongoing strategic capital deployment, BTCS has increased its Ethereum (ETH) reserves by 14,240 ETH, bringing total holdings to 70,028 ETH with a fair market value of approximately $270 million based on an ETH price of $3,850. Further, during the week ending July 25, 2025 the Company only sold 271,580 shares under its ATM program in a single block trade at $6.04 per share for $1.64 million. As a result, the total number of common shares outstanding now stands at 47,852,778.

“Surpassing $270 million in ETH reserves that are generating revenue and yield for our shareholders through NodeOps (staking) and Builder+ (block building) is a tremendous achievement,” said Charles Allen, CEO of BTCS. “Successfully closing the $10 million financing at a substantial premium is yet another testament to the strength and market confidence in our hallmark DeFi/TradFi Accretion Flywheel strategy. We are hitting our stride of actively deploying capital to not only expand our ETH treasury but also fuel our blockchain infrastructure operations and are proud to continue our trajectory as the most financially and operationally leveraged Ethereum play in public markets today.”

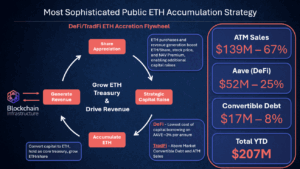

BTCS continues to successfully execute its DeFi/TradFi Accretion Flywheel capital formation strategy, leveraging both decentralized and traditional finance to expand its ETH holdings, capitalize on its vertically integrated operations, and enhance shareholder value. The Company has now raised approximately $207 million year-to-date through a mix of at-the-market equity sales, above-market convertible debt, and DeFi-based borrowing, all aligned with its strategy to optimize ETH exposure while actively managing dilution.

About BTCS:

BTCS Inc. (“BTCS” or the “Company”), short for Blockchain Technology Consensus Solutions, is a U.S.-based Ethereum-first blockchain technology company committed to driving scalable revenue and ETH accumulation through its hallmark strategy, the DeFi/TradFi Accretion Flywheel, an integrated approach to capital formation and blockchain infrastructure. By combining decentralized finance (“DeFi”) and traditional finance (“TradFi”) mechanisms with its blockchain infrastructure operations, comprising NodeOps (staking) and Builder+ (block building), BTCS offers one of the most sophisticated opportunities for leveraged ETH exposure, driven by scalable revenue generation and a yield-focused ETH accumulation strategy. Discover how BTCS offers operational and financial leveraged exposure to Ethereum through the public markets at www.btcs.com.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release constitute “forward-looking statements” within Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 including statements strategy to optimize ETH exposure while actively managing dilution and driving scalable revenue generation. Words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “predict,” “forecast,” “project,” “plan,” “intend” or similar expressions, or statements regarding intent, belief, or current expectations, are forward-looking statements. While the Company believes these forward-looking statements are reasonable, undue reliance should not be placed on any such forward-looking statements, which are based on information available to us on the date of this release. These forward-looking statements are based upon assumptions and are subject to various risks and uncertainties, including without limitation market conditions, regulatory issues and requirements, unanticipated issues with our At-The-Market Offering facility, unexpected issues with Builder+, as well as risks set forth in the Company’s filings with the Securities and Exchange Commission including its Form 10-K for the year ended December 31, 2024 which was filed on March 20, 2025. Thus, actual results could be materially different. The Company expressly disclaims any obligation to update or alter statements, whether as a result of new information, future events or otherwise, except as required by law.

For more information follow us on:

Twitter: https://x.com/NasdaqBTCS

LinkedIn: https://www.linkedin.com/company/nasdaq-btcs

Facebook: https://www.facebook.com/NasdaqBTCS

Investor Relations:

Charles Allen – CEO

X (formerly Twitter): @Charles_BTCS

Email: [email protected]